INDIA PROTECTION QUOTIENT 5.0

Instituted in 2019, India Protection Quotient is an annual property by Max Life Insurance in association with Kantar, aimed to understand the pulse of the Indian consumers in the financial protection space. Through the 5th edition of the study titled ‘India Protection Quotient 5.0’, the state of Urban Indians with regards to current financial security levels, changing savings & investment patterns, and key anxieties & triggers of financial protection in a contemporary world is revealed.

INDIA PROTECTION QUOTIENT 5.0

Instituted in 2019, India Protection Quotient is an annual property by Max Life Insurance in association with Kantar, aimed to understand the pulse of the Indian consumers in the financial protection space. Through the 5th edition of the study titled ‘India Protection Quotient 5.0’, the state of Urban Indians with regards to current financial security levels, changing savings & investment patterns, and key anxieties & triggers of financial protection in a contemporary world is revealed.

Key Metrics of Survey

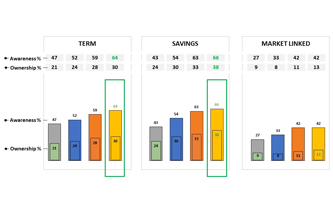

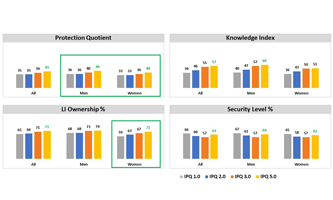

India Protection Quotient

The degree to which Indians feel protected from future uncertainties, on a scale of 0 to 100. It is a proprietary tool developed by Max life with KANTAR for assessing how protected urban India is. It is based on the attitudes, mental preparedness around future uncertainties, awareness, and ownership of life insurance product categories (Term, Endowment, and ULIP)

Knowledge Index

The degree to which Indians are aware of life insurance products, on a scale of 0 to 100. It is derived from awareness across life insurance product categories (Term, Endowment, and ULIP).

Ownership Level

The degree to which Indians own Life insurance, on a scale of 0 to 100. It is basis ownership of financial instruments (Term, Endowment, and ULIP).

Security Level

The degree to which Indians feel financially secure and prepared on a scale of 0 to 100. It is derived from consumer attitudes across a battery of 10 financial facets.

Who did We Ask?

Conducted entirely online, the India Protection Quotient 5.0 surveyed 4,610 respondents across 25 Indian cities, including metro, Tier 1, and Tier 2 cities [from November 2022 to December 2022].

4610

Respondents

25-55 years

Age Group

> 2 Lakhs

Annual Household Income

25 Cities

(6 Metro + 9 Tier-1 + 10 Tier-2)

NCCS AB

Households

70:30 Ratio

X475(H) PX_IPQ WEBSITE BANNER.jpg)