Written by

Updated :

Reviewed by

On this Page

The National Pension System or NPS was initially introduced in 2004 as a government-sponsored long-term investment pension scheme to replace traditional central and state government pension scheme. Subsequently, this pension scheme was opened for everyone in 2009. Currently this pension scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and Central Government.

What is NPS?

NPS is one of the best investment plan governed by the Regulatory and Development Authority for the Pension Fund (PFRDA). PFRDA founded National Pension System Trust (NPST) which is the registered owner of all assets under this investment plan. NPS full form is National Pension System.

At first, only the Central Government employees were covered by the National Pension Scheme. Now NPS is made open to all the Indian citizens. NPS scheme holds immense value for anyone working in the private sector and needs a regular post-retirement pension. The NPS is flexible across occupations and locations with tax advantages in investment under Section 80C and Section 80CCD (1B).

Also Read: How to Choose the Right Pension Plan

NPS Returns 2023

Due to the market-linked nature of NPS investments, their returns are not guaranteed and vary based on the performance of debt and equity markets along with the investments made by the different pension fund managers. The below table shows the 1 year, 3 year and 5 year returns of different Tier 1 account NPS funds as of 31st March 2023:

Pension Fund (Asset Class C Tier 1) |

1 Year Returns |

3 Year Returns |

5 Year Returns |

Aditya Birla Sun Life Pension Management Ltd. |

1.70% |

26.37% |

11.39% |

Axis Pension Fund Management Limited* |

NA |

NA |

NA |

HDFC Pension Management Co. Ltd. |

2.08% |

27.34% |

12.36% |

ICICI Pru. Pension Fund Mgmt Co. Ltd. |

1.51% |

27.94% |

11.68% |

Kotak Mahindra Pension Fund Ltd. |

2.71% |

28.11% |

11.68% |

LIC Pension Fund Ltd. |

2.82% |

29.23% |

11.22% |

Max Life Pension Fund Management Limited* |

NA |

NA |

NA |

SBI Pension Funds Pvt. Ltd |

1.81% |

25.94% |

11.12% |

Tata Pension Management Ltd.* |

NA |

NA |

NA |

UTI Retirement Solutions Ltd. |

2.53% |

27.96% |

11.30% |

*These NPS pension funds have been recently launched and have not completed 1 year of operation as of 31st March 2023.

Pension Fund (Asset Class C Tier 1) |

1 Year Returns |

3 Year Returns |

5 Year Returns |

Aditya Birla Sun Life Pension Management Ltd. |

3.71% |

6.65% |

7.93% |

Axis Pension Fund Management Limited* |

NA |

NA |

NA |

HDFC Pension Management Co. Ltd. |

3.72% |

7.01% |

8.12% |

ICICI Pru. Pension Fund Mgmt Co. Ltd. |

3.43% |

6.78% |

7.70% |

Kotak Mahindra Pension Fund Ltd. |

3.53% |

6.02% |

6.96% |

LIC Pension Fund Ltd. |

3.60% |

6.90% |

7.78% |

Max Life Pension Fund Management Limited* |

NA |

NA |

NA |

SBI Pension Funds Pvt. Ltd |

3.41% |

6.62% |

7.80% |

Tata Pension Management Ltd.* |

NA |

NA |

NA |

UTI Retirement Solutions Ltd. |

3.38% |

6.32% |

7.34% |

*These NPS pension funds have been recently launched and have not completed 1 year of operation as of 31st March 2023.

Pension Fund (Asset Class G Tier 1) |

1 Year Returns |

3 Year Returns |

5 Year Returns |

Aditya Birla Sun Life Pension Management Ltd. |

5.27% |

5.67% |

8.17% |

Axis Pension Fund Management Limited* |

NA |

NA |

NA |

HDFC Pension Management Co. Ltd. |

5.17% |

5.62% |

8.27% |

ICICI Pru. Pension Fund Mgmt Co. Ltd. |

4.85% |

5.38% |

7.94% |

Kotak Mahindra Pension Fund Ltd. |

5.01% |

5.54% |

8.11% |

LIC Pension Fund Ltd. |

5.14% |

5.53% |

8.71% |

Max Life Pension Fund Management Limited* |

NA |

NA |

NA |

SBI Pension Funds Pvt. Ltd |

4.58% |

5.43% |

7.97% |

Tata Pension Management Ltd.* |

NA |

NA |

NA |

UTI Retirement Solutions Ltd. |

5.17% |

5.46% |

7.81% |

*These NPS pension funds have been recently launched and have not completed 1 year of operation as of 31st March 2023.

Pension Fund (Asset Class A Tier 1) |

1 Year Returns |

3 Year Returns |

5 Year Returns |

Aditya Birla Sun Life Pension Management Ltd. |

2.22% |

5.36% |

5.89% |

Axis Pension Fund Management Limited* |

NA |

NA |

NA |

HDFC Pension Management Co. Ltd. |

5.07% |

8.78% |

8.34% |

ICICI Pru. Pension Fund Mgmt Co. Ltd. |

2.05% |

7.92% |

6.39% |

Kotak Mahindra Pension Fund Ltd. |

1.12% |

5.38% |

6.34% |

LIC Pension Fund Ltd. |

5.77% |

7.49% |

7.81% |

Max Life Pension Fund Management Limited* |

NA |

NA |

NA |

SBI Pension Funds Pvt. Ltd |

1.02% |

9.31% |

8.35% |

Tata Pension Management Ltd.* |

NA |

NA |

NA |

UTI Retirement Solutions Ltd. |

4.27% |

5.56% |

6.09% |

*These NPS pension funds have been recently launched and have not completed 1 year of operation as of 31st March 2023. Returns data provided above is as of 31st March 2023.

What are the Types of National Pension System Account?

Under National Pension Scheme, there are two primary account categories—Tier I and Tier II. [2] The former is the default account, whereas the latter is a voluntary supplement. The following section will explain the two account types.

The two types of NPS accounts offered by PRAN are as follows:

Tier-I Account: You will contribute your savings for retirement into this non-withdrawable account. Investment made under this section can be claimed as a deduction up to Rs.1.5 lakh under Section 80C of the Income Tax Act, 1961. Additionally, you can invest and claim up to Rs.50000 as deduction under Section 80CCD (1B) of the Income Tax Act, 1961.

Under National Pension Scheme, there are two primary account categories—Tier I and Tier II. [2] The former is the default account, whereas the latter is a voluntary supplement. The following section will explain the two account types.

The two types of NPS accounts offered by PRAN are as follows:

Tier-I Account: You will contribute your savings for retirement into this non-withdrawable account. Investment made under this section can be claimed as a deduction up to Rs.1.5 lakh under Section 80C of the Income Tax Act, 1961. Additionally, you can invest and claim up to Rs.50000 as deduction under Section 80CCD (1B) of the Income Tax Act, 1961.

Tier-II Account: It is a voluntary retirement cum saving type of account. You will only be able to open a Tier-II account if you already have a NPS Scheme Tier I account. Whenever you wish, you will be free to withdraw your money from this account.

Tier-II Account: It is a voluntary retirement cum saving type of account. You will only be able to open a Tier-II account if you already have a NPS Scheme Tier I account. Whenever you wish, you will be free to withdraw your money from this account.

If you do not wish to choose asset allocation, your money will be invested according to the "Auto Variety" option.

You can open an account in the NPS Scheme with authorized service provider branches called ‘Points of Presence' (POPs). You have the right, at your convenience, to turn from one branch of a POP to another. The tax benefits under National Pension System in India may be amended from time to time as set out in terms of the Income Tax Act, 1961.

NPS Asset Classes

Subscribers of NPS can choose to allocate their investment across 4 different asset classes. These 4 asset classes are as follows:

Asset Class |

Primary Investment |

E |

Equity |

C |

Corporate Bonds |

A |

Alternative Assets like REITs & InVITs |

G |

Government Bonds |

There are four asset classes in National Pension Scheme. Asset Class E has investments in equities such as equity stocks and equity derivatives. Asset Class C and G are pure debt investments. While Class C investments primarily in Corporate Bonds, Asset Class G primarily invests in Central and State Government Bonds. Asset Class A invests primarily in alternative assets like Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

Choice of Pension Fund Managers in National Pension System

NPS allows investors to choose their NPS fund manager for NPS Tier 1 and Tier 2 accounts. Current list of PFRDA-approved fund managers for the NPS scheme include:

· Aditya Birla Sun Life Pension Management

· Axis Pension Fund Management Limited

· HDFC Pension Management Co. Ltd

· ICICI Prudential Pension Fund Management Co. Ltd.

· Kotak Mahindra Pension Fund Ltd.

· LIC Pension Fund Ltd.

· Max Life Pension Fund Management Limited

· SBI Pension Funds Pvt. Ltd

· Tata Pension Management Ltd.

· UTI Retirement Solutions Ltd.

NPS Investment Options: Active Choice & Auto Choice

Subscribers of the National Pension System also have the option of choosing the asset allocation across the 4 asset classes of Equity, Corporate Bonds, Government Bonds and Alternative Investments. For subscribers who want to do this asset allocation by themselves, the active choice option is more suitable while the auto choice option might be more suitable if an investor is unsure about what NPS investments to make.

H3: Active Choice

As mentioned earlier, in active choice, the investor decides the split between different asset classes in active choice option. There is however some restriction with respect to equity allocation in NPS based on the age of the investor. The below table shows the Maximum Equity Allocation allowed under the active choice option:

Age (in years) |

Maximum Equity Allocation (%) |

Upto 50 years |

75% |

51 years |

72.50% |

52 years |

70% |

53 years |

67.50% |

54 years |

65% |

55 Years |

62.50% |

56 Years |

60% |

57 Years |

57.50% |

58 Years |

55% |

59 Years |

52.50% |

60 Years |

50% |

H3: Auto Choice

The auto choice option of NPS allows investors to automatically change their asset allocation towards different asset classes based on the age and risk tolerance of the investor. Under the auto choice option, the investor can choose 1 of the 3 life cycle funds known as LC75 (Aggressive Life Cycle Fund), LC50 (Moderate Life Cycle Fund) and LC25 (Conservative Life Cycle Fund). Below are the asset allocation limits for these life cycle funds, where E is equity allocation, C is corporate bond allocation and G is Government bond allocation:

Investor Age |

LC75 (Aggressive) |

LC50 (Moderate) |

LC25 (Conservative) |

||||||

E |

C |

G |

E |

C |

G |

E |

C |

G |

|

Upto 35 years |

75% |

10% |

15% |

50% |

30% |

20% |

25% |

45% |

30% |

40 years |

55% |

15% |

30% |

40% |

25% |

35% |

20% |

35% |

45% |

45 years |

35% |

20% |

45% |

30% |

20% |

50% |

15% |

25% |

60% |

50 years |

20% |

20% |

60% |

20% |

15% |

65% |

10% |

15% |

75% |

55 Years and older |

15% |

10% |

75% |

10% |

10% |

80% |

5% |

5% |

90% |

As you can see from the above table, as the age of the subscriber increases, the equity allocation of the NPS portfolio is automatically decreased and moved into potentially lower volatility asset classes like corporate debt and Government securities. This is designed to decrease the potential risk in the investor’s portfolio as one gets closer to retirement.

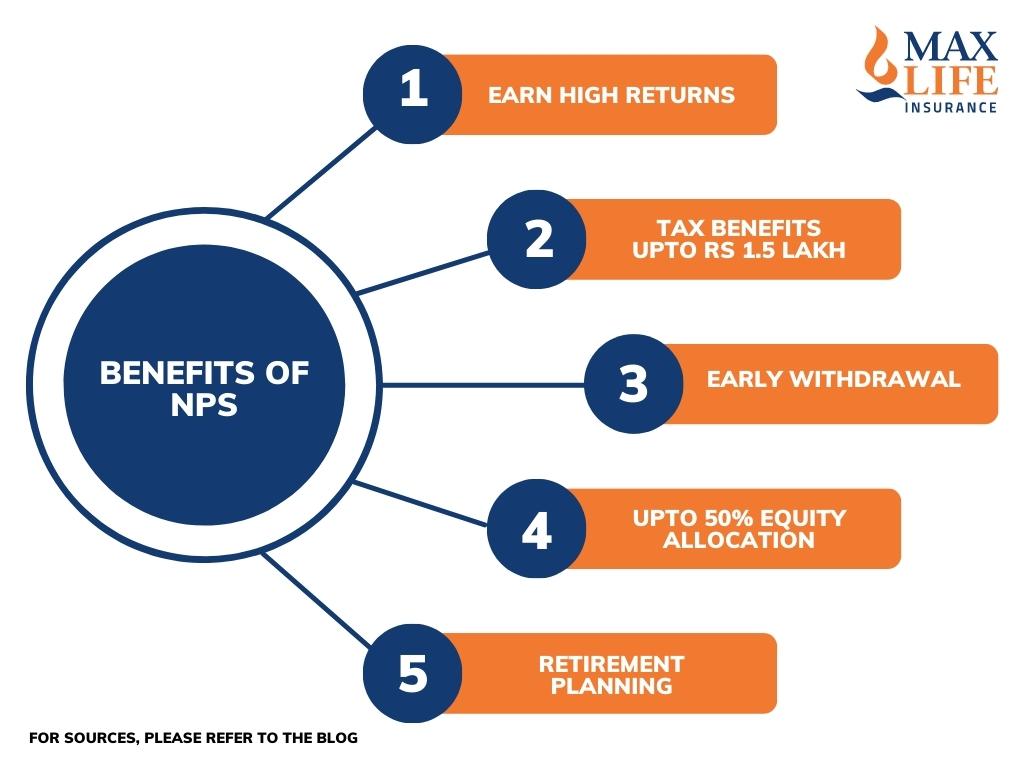

What are the Features & Benefits of the National Pension System (NPS)

1. Earn High Returns with NPS

NPS does offer returns significantly higher than other conventional tax-saving investments, such as the PPF etc. With NPS scheme, you can earn annualised returns of 8% to 10%. NPS returns are not fixed and vary as funds in National Pension Scheme are market linked.

2. Assess your Risk

There is currently a limit on equity exposure for the National Pension System (NPS) that ranges between 50% to 75%. This limit is 50% for government employees. Every year, beginning from the year the investor turns 50 years of age, the equity component will decrease by 2.5% within the specified range.

Nevertheless, the cap is set at 50% for an investor of 60 years of age and above. It stabilizes the risk-return equation for investors' interests, ensuring the portfolio is somewhat free from the fluctuations of the equity market.

3. NPS Tax Benefits

Investment made to NPS scheme is allowed a deduction up to Rs.1.5 lakh for your contribution as well as for the employer's contribution.

80CCD (1) includes self-contribution, which is part of investment under Section 80C. The overall deduction in the investment under 80CCD (1) is 10% of the wage, but not more than that. This cap is 20 percent of gross income for the self-employed taxpayer.

80CCD (2) protects the employer's NPS contribution, which does not form part of Section 80C. This provision does not apply to self-employed taxpayers. The maximum amount eligible to be deducted shall be the lowest of the following: a. Actual NPS contribution by employer b. 10% of Basic + DA c. Gross total income

You can claim other self-contribution (up to Rs.50,000) of investment under section 80CCD(1B) to get NPS tax benefit, which makes it one of the best investment plans having a tax deduction of up to Rs.2 lakh in total.

Also Read: Best Long Term Tax Saving Investments under Section 80C

4. Withdrawal Rules After 60

Contrary to common opinion, upon your retirement, you cannot withdraw the entire corpus from this best investment plan. To earn a monthly pension from a PFRDA-registered insurance firm, you are obliged to keep at least 40% of the corpus aside. The remaining 60% will be tax-free. This is one of the highlights that make NPS the best investment option in India.

5. Early Withdrawal Allowed

4. Withdrawal Rules After 60

Contrary to common opinion, upon your retirement, you cannot withdraw the entire corpus from this best investment plan. To earn a monthly pension from a PFRDA-registered insurance firm, you are obliged to keep at least 40% of the corpus aside. The remaining 60% will be tax-free. This is one of the highlights that make NPS the best investment option in India.

It is necessary for you to continue investing until the age of 60 in NPS scheme. Nevertheless, if you've been saving for at least 3 years, you can withdraw up to 25% for specific purposes. These include wedding or higher studies for girls, building / buying a home, or self/family medical care, amongst others.

During the entire tenure, you can make a withdrawal from your NPS account for up to three times (with a period of 5 years). Just Tier I account, and not Tier II accounts, are subject to these limitations.

6. Up to 50% Equity Allocation

Being one of the best investment options in India, NPS invests in equity. Up to 50 percent of your savings can be allocated to equities. There are two options to invest - either auto-selection or active choice.

The auto-selection will determine your risk profile for this investment option in India according to your age. The older you are, for instance, the more stable and the less volatile your investments are. The active option allows you to decide the scheme and to split your investments

Tax Benefits of National Pension System

There are different NPS tax benefits that investors can consider. Below are a few key tax saving benefits investors should consider:

1. NPS investments allow you to claim up to Rs 1.5 lakh under Section 80C of Income Tax.

2. One can also claim incremental tax benefits on investments up to Rs 50,000 under (1b) subsection of Section 80CCD of the Income Tax Act. This is over and above the limit of Rs 1.5 lakh u/s 80C.

Subscriber of corporate and government NPS option get additional tax savings beyond 80CCD(1b) and 80C tax benefits on contribution made by their employer. As per current NPS rules, the limit is up to 12% of basic salary for central/state government NPS account holder and 10% for corporate NPS subscribers.

How to Open NPS Account?

1. Offline Process

You can open an account in NPS Scheme. You'll need first to find a PoP-Point of Presence (it might be a bank too). Download and send a subscriber form from your nearest PoP along with the KYC paperwork. Ignore whether that bank even complies with KYC.

The PoP will give you a PRAN–Permanent Retirement Account Number after you make the initial investment (no less than Rs. 500 or Rs. 250 monthly or Rs. 1,000 annually). This number and password will help you run your account in your sealed welcome box. This procedure has a one-time registration fee of Rs.125.

2. Online Process

You can also open an account in NPS Scheme online. It's easy to open an online account (enps.nsdl.com) if you connect your account to your PAN, Aadhaar and mobile number. The NPS registration can be checked using the OTP sent to your mobile phone. It will create a PRAN (Permanent Retirement Account Number) that can be used for NPS login.

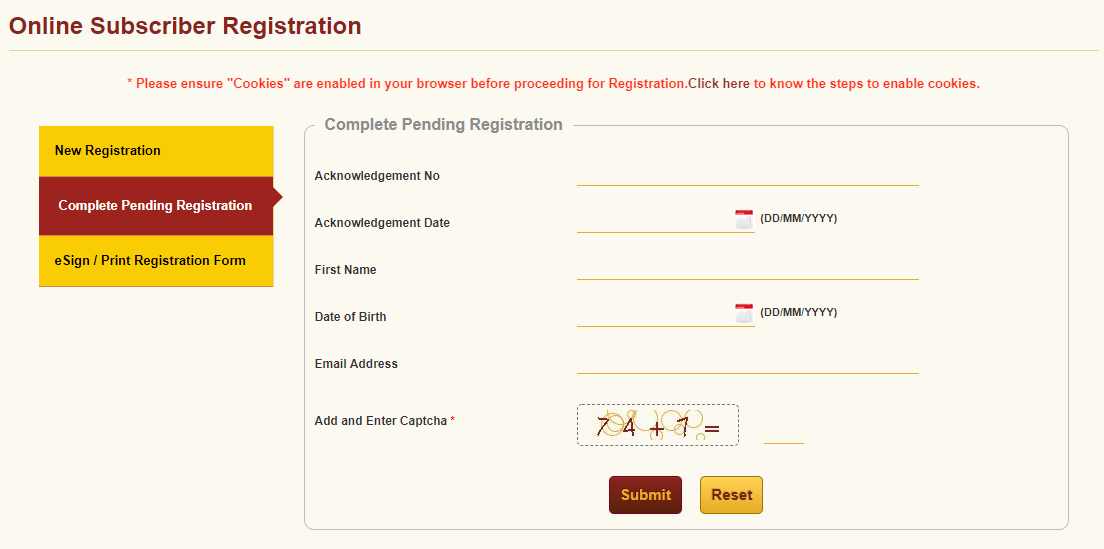

How to do NPS Registration?

For NPS online registration, you need to click here and follow the steps mentioned below:

1. New NPS Registration

The above screenshot is for the new NPS registration online portal. First, choose the appropriate options from the choices given below:

- Applicant Type (Individual Subscriber or Corporate Subscriber)

- Status of Applicant (Citizens of India or Non-Resident of India)

- Register with (Permanent Account Number)

- Account Type (Tier I & Tier II or Tier I only)

- Bank/ POP

Then, click on continue to proceed with the NPS registration completion.

2. Complete Pending NPS Registration

The above screenshot is to complete the pending NPS registration. You’ll have to fill your Acknowledgement No, Acknowledgement Data, First Name, Date of Birth and Email Address. Select submit to continue.

3. eSign/ Print Registration Form

How to Do NPS Login?

There are two portals through which you can do NPS login.

NSDL NPS Portal

You can sign in to the NSDL NPS server in two ways. First, if you have a password already. Another way is that if you have not created a password and are first signing into your PRAN account.

Here are the steps that you need to follow if you already have a password.

1. Go to the NSDL NPS portal npscra.nsdl.co.in for the NPS login

2. Click on the' Open or Add your NPS account ' button

3. Next, you’ll see a button saying, 'Log in with PRAN/IPIN’ [3], click on it

4. Enter your PRAN and password on the login screen, followed by 'Submit' for gaining access to your E-NPS account[1]. You'll need to create a password using the steps outlined below when you log in for the first time

- Go the official portal of NSDL NPS (npscra.nsdl.co.in)

- Click on 'Open your NPS account or contribute online'

- Click next on, 'Log in with PRAN/IPIN'

- Select ' eNPS password’ to create a new password

- Fill in your date of birth. Type the new password and then verify it. After entering the captcha and hit 'Submit'

- You’ll receive an OTP on your mobile phone. There will be an empty field reading' Access OTP,' and you'll need to key in the OTP to validate your new password

5. You can now access your E-NPS account with the PRAN and the new password

Karvy NPS Portal

1. Go to the official Karvy NPS portal

2. Select “Login for existing subscribers”

3. To log in to your E-NPS account, type your PRAN and Password on the login screen

4. Follow the below steps to generate a new password

- Click on the link “Click here to generate password” on the login screen

- Enter your PRAN, date of birth and captcha. Once you click on submit, you will receive an OTP on your registered mobile number

- The OTP will help you to set the new password

- You can now login to your E-NPS account with this password

What are the Different Forms under the National Pension Scheme (NPS)?

national pension scheme is a contribution-based retirement plan governed by pfrda and funded by the indian government. registration for the national pension scheme is necessary for various nps forms. here we have mentioned that exhaustive list of nps forms below. you can download nps forms below:

1. Form CSRF: Subscriber Registration Form

2. Annexure I: Tier II Details

3. Annexure-II: Additional Request Details

4. Annexure III: Additional Nomination Details

5. Form NSRF: Subscriber Registration Form-NRI

6. Subscriber Registration Form NSRF Annexure I

7. Subscriber Registration Form NSRF Annexure-II

8. S10-Subscriber Registration Form Tier-II

9. Press Release by Pension Fund Regulatory & Development Authority (PFRDA)

Charges for Investing in National Pension System

Since NPS funds are managed by a designated fund manager, the subscriber needs to pay a few fees and charges related to account opening, maintenance, transaction fees, etc. The following table lists the different charges related to NPS:

Intermediary |

Charge Category |

NPS Service Charges* |

Central Record-Keeping Agency (CRA) Charges |

Account Opening charges with Physical PRAN Card |

Rs. 40 |

Physical Welcome Kit (at time of account opening) |

Rs. 35 |

|

Welcome Kit through email (at account opening) |

Rs. 18 |

|

Annual Maintenance cost per account |

Rs. 69 |

|

Charge per transaction |

Rs. 3.75 |

|

Point-of-Presence (PoP) |

Initial subscriber registration and contribution upload |

Min. Rs. 200, Max. Rs. 400 |

Subsequent Transactions |

0.50% of contribution amount from subscriber subject to a minimum of Rs.30 and a maximum of Rs. 25,000. |

|

Subsequent Non-Financial Transactions |

Rs. 30 |

|

Contribution through e-NPS |

0.20% of contribution (min. Rs. 15, max. Rs. 10,000) |

How to Use the NPS Calculator?

Use an NPS Calculator and look at the benefits of the NPS pension scheme like tax benefits, the wealth generated and the monthly pension amount. The NPS pension calculator demonstrates the tentative Pension and Lump Sum amount an NPS subscriber may require on maturity or 60 years of age.

Step 1: Choose the NPS contributor you fall under.

Step 2: Select who you are associated with.

Step 3: Choose the period, and then the NPS calculator will assess your NPS return for various POPs.

Use an NPS Calculator and look at the benefits of the NPS pension scheme like tax benefits, the wealth generated and the monthly pension amount. The NPS pension calculator demonstrates the tentative Pension and Lump Sum amount an NPS subscriber may require on maturity or 60 years of age.

Step 1: Choose the NPS contributor you fall under.

Step 2: Select who you are associated with.

Step 3: Choose the period, and then the NPS calculator will assess your NPS return for various POPs.

How does NPS scheme Compare Against other Tax Saving Instruments

additional common tax-saving investments under section 80c, apart from the nps are equity linked savings scheme (elss), public provident fund (ppf), and fixed deposits (fd). now that you know what is nps and how it works, here's a quick comparison between other tax saving investments and nps:

Type of Investment |

Rate of Interest* |

Lock-in period |

Risk-Profile |

National Pension System |

8% to 10% (expected) |

Till retirement |

Market-related risks |

Equity Linked Savings Scheme |

12% to 15% (expected) |

3 years |

Market-related risks |

Public Provident Fund |

7.1% (guaranteed) |

15 years |

Risk-free |

Fixed Deposit |

4% to 9% (guaranteed) |

5 years |

Risk-free |

*Rate of Interest mentioned are just for reference and can vary from time to time. Rate of interest mentioned for the above investments can change without prior information.

NPS scheme can get higher returns than the PPF or FDs, but at maturity, it is not as tax efficient. For example, you can withdraw from your NPS account up to 60 percent of your accumulated amount. Taxability on exclusion from the NPS is subject to change.

NPS v/s Atal Pension Yojana

Check the difference between National Pension System and Atal Pension Yojana below:

Feature |

NPS |

Atal Pension Yojana |

Joining Age |

The minimum entry age is of 18 years whereas the maximum is 55 years |

The entry age 18 years, whereas the maximum age being only 40 years. |

Who can Invest |

Citizens of India as well as NRIs[4] |

Only a resident of India |

Pension particulars |

It does not invest a pension post-retirement |

It provides you with a guaranteed pension after retirement |

Tax Benefits |

Provides a tax rebate of up to Rs. 2 lakh. |

No tax benefits |

Withdrawal Before the End of Term |

Tier 2 accounts can withdraw before the end of the term |

You are not allowed to withdraw the money invested before the term ends |

Account Type |

Provides two types of accounts, Tier I and Tier II. |

Provides investors with just one account type |

Government Contribution |

No government support |

Some monetary support |

NPS v/s Voluntary Pension Fund (VPF)

There are critical differences between NPS and Voluntary Pension Fund (VPF) that are listed here:

1. NPS covers the persons who are in the unorganized sector, whereas Voluntary Pension Fund (VPS) only covers the organized sector employees.

2. NPS provides options of equity, corporate debt and government bond while VPF works mostly as a debt instrument, with an upper capping of 15% on equity allocation.

3. The amount of investment is different. For NPS, an employee's annual contribution of Rs. 6000 is the minimum prerequisite, while in VPF, an employee is expected to pay 12 percent of the salary to the fund.

4. In the case of VPF, the Central Board of Trustees of the Workers Provident Fund Association (EPFO) determines the annual interest rate to be paid every year (currently 8.65%), whereas NPS is a market-linked product.

5. Tax benefits vary for the schemes. As per section 80C, the investment pool, as well as the interest in VPF, are eligible for an income tax deduction of up to Rs. 1.5 Lakh. It varies though in the case of NPS. A deduction under section 80 C of up to Rs. 1.5 Lakh is permissible.

Secure Yourself Financially Post-Retirement

One of the key benefits of retirement planning through this best investment plan is that while saving for your future, you get to benefit from the tax advantages today. NPS comes with several tax benefits. Other that NPS, we at Max Life Insurance offer you a wide range of saving plans. You can calculate the premium of these tax-saving investment plans and accordingly choose the best one for yourself.

Secure Yourself Financially Post-Retirement

Secure Yourself Financially Post-RetirementOne of the key benefits of retirement planning through this best investment plan is that while saving for your future, you get to benefit from the tax advantages today. NPS comes with several tax benefits. Other that NPS, we at Max Life Insurance offer you a wide range of saving plans. You can calculate the premium of these tax-saving investment plans and accordingly choose the best one for yourself.

FAQs on National Pension Scheme

1. Are NPS returns taxable?

On lumpsum withdrawal after the age of 60 years, up to 40% withdrawal in lumpsum of the total corpus is fully exempt from tax.

2. Is it worth to invest in NPS?

Yes, NPS is one of the worthy choices to build a retirement corpus. It is because it qualifies for the standard tax-saving space under Section 80C of Rs.1.5 lakh. And, an additional Rs.50000 under Section 80CCD (1B) is also exclusive for an NPS investment.

3. Who can open the NPS account?

Both the residents of India, as well as the Non-residential Indians (NRIs), can open an NPS account.

4. Is NPS voluntary?

Yes, the National Pension System (NPS) is a voluntary pension scheme managed and governed by the Regulatory and Development Authority of the Pension Fund (PFRDA), established by a Parliament of India act.

5. How can I deduct NPS in ITR?

There is a deduction for NPS of up to Rs.1.5 lakh for your payment as well as for the employer's contribution. –80CCD (1B) is self-contribution, a member of Section 80C.

Sources:

[1]https://www.coverfox.com/personal-finance/saving-schemes/nps-login-registration/

[2] https://economictimes.indiatimes.com/mf/nps-national-pension-scheme

[3] https://cleartax.in/s/nps-login

[4] https://www.bankbazaar.com/saving-schemes/nps-vs-apy.html

ARN:- Sep/Bg/28P